Newsletter #140 – the end NAO 2025 – Did you know? CSE Budget and Rules 2025

After several meetings in January, the NAO 2025 resulted in an agreement signed by three of the four unions.

The CFDT signed the agreement, although it deplores management’s unilateral decision to abolish the profit-sharing supplement paid equally to all employees since 2020 (€1,000 and €1,300 in 2024).

This signature is assumed to ensure the application of other measures such as: 9% profit-sharing vs. 5.5%, 60% reimbursement by management of mutual health insurance contributions… as well as other benefits requested for several years, such as day(s) off for relocation.

Over the years, negotiations have become increasingly limited as French management applies Group directives and there is little room for maneuver.

Don’t hesitate to give us your feelings and comments.

End of NAO-Obligatory Annual Negotiation 2025

The NAO 2025 got off to a good start with a proposal for partial compensation for the loss of profit-sharing due to the IP Box*, « without consideration » .

However, at the next meeting, management announced the « non-renewal » of the €1,300 profit-sharing supplement negotiated in previous years. Despite our many protests and arguments, management did not reverse this decision.

Here are the CFDT’s proposals and management’s responses (french only). The results of this NAO in two main parts:

Salary policy (Compensation and value sharing)

- Salary increase: 2.8%, +0.2% for high-voltage professions (excluding promotions and professional equality envelope).

- Individual bonus: 5% as in previous years.

- Company bonus (Interessement): as in previous years, with a 4% target for staff. The % should be announced at the end of February after publication of the 2024 results.

- Profit-sharing** (Participation): the floor of 5.5% provided for in the profit-sharing agreement has been raised to 9% this year to compensate for the IP Box* effect.

Social benefits (working hours, professional equality and QVT-Quality of Life at Work)

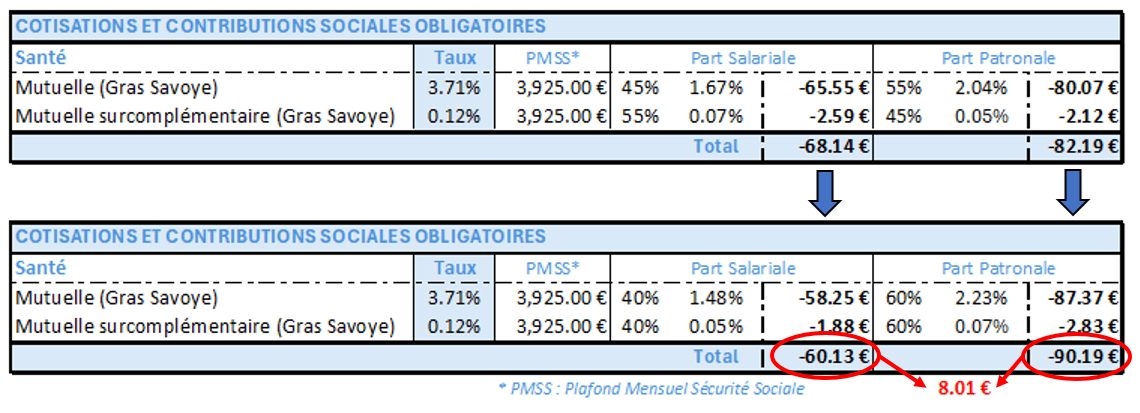

- Health expenses** : 60% paid by the employer

- €87.37/month instead of €80.07 on the basic mutual insurance plan

- €2.83/month instead of €2.12 on complementary health insurance

- Teleworking allowance** : €2.70/day instead of €2.60

- €351 max per year instead of €338

- €81 max per year instead of €78 for workcation

- Company restaurant participation: minimum employee participation of €2.73

- Paris: €6.31/meal instead of €3.00

- Strasbourg: €7.00/meal instead of €4.60

- Menstrual leave** : 13 days/year, for women with specific recognition from the occupational physician. On average, 10% of women are affected.

- Experiment from April 2025 to March 2026.

- Caregiver leave** : 5 days/year, for a relative abroad excluded from the French legal system.

- Relocation leave** : 1 day/year, with justification

- Guidelines on the application of the 2025 « Salary Review » communicated to managers abroad

- Communication to all employees of the rules governing the granting of “EWT – Exceptional Working Time”.

- A booklet for future parents** on parenting facilities. In the meantime, here are some useful pages:

- Néo pages: Intercompany childcare and Becoming a parent

- CSE pages: Crèches, What to do when my child arrives? and How to choose my child’s childcare provider?

Don’t hesitate to contact us with any questions you may have or to pass on information.

** For lack of signature these elements would not have been obtained

* The IP Box allows income from the sale/licensing/sublicensing of intellectual property rights (patents, software, plant breeders’ rights, industrial processes, etc.) to be taxed at a reduced rate: 10% instead of 25%. (cf French law article 238 du Code Général des Impôts).

Did you know?

Do you know all the rules and regulations governing social and cultural activities ?

- In our special newsletter « Budget CSE 2025 » (french only), we offer you a summary of the 2025 budget, as well as the current rules governing the CSE’s social and cultural activities.

- The CSE website is the reference and we will update our summary as necessary.